Green Bonds

As part of its efforts to contribute to the development of sustainable society, CRR has issued the Green Bonds. CRR aims to further promote its sustainability initiatives through issuance of the green bonds, and invite new investors to its investment corporation bonds by stimulating their demand who have interest in ESG investment.

About Green Bonds

Green bonds are a type of bond instruments where the proceeds will be exclusively applied to finance or refinance green projects such as countermeasures against global warming or businesses with environmental benefits and that are generally aligned with the Green Bond Principles, a voluntary guideline of International Capital Market Association (ICMA).

For details, please refer to the ICMA’s website linked below.

For details, please refer to the ICMA’s website linked below.

ICMA Green Bond Principles (GBP)

CRR’s Green Bond Framework has been reviewed by Sustainalytics, an ESG rating agency, and received from them a second-party opinion with regard to the eligibility.

For details, please refer to the second-party opinion from Sustainalytics linked below.

Second-Party Opinion from Sustainalytics

Green bond Framework

1. Use of Proceeds

The proceeds of the green bond will be allocated to acquire the existing or new buildings that meet the following Eligibility Criteria A (‘Eligible Green Projects’), or refurbishments that meet the following Eligibility Criteria B or to refinance the existing loan/investment corporation bonds which have been allocated to Eligible Green Projects or refurbishments.

2. Eligibility Criteria

CRR shall apply one or more of the following criteria to allocate the proceeds into Eligible Projects:

A. Eligible Green Projects

Buildings that have achieved the following top three levels of third-party green building certification/recertification within 36 months prior to the payment date of green bonds or will achieve:

① B+, A or S Rank under CASBEE

② 3, 4 or 5 Stars under DBJ Green Building Certification Program

③ 3, 4 or 5 Stars under BELS

B. Refurbishments

Refurbishments with a primary purpose of achieving one of the following criteria and are completed within 36 months prior to the payment date of green bond or will be completed:

① Refurbishments with more than 20% reduction in energy consumption and water consumption

② Newly achieve the top three levels of green building certifications listed above Eligibility Criteria A or more than one level of star/rank improvement in the green building certifications

3. Management of Proceeds

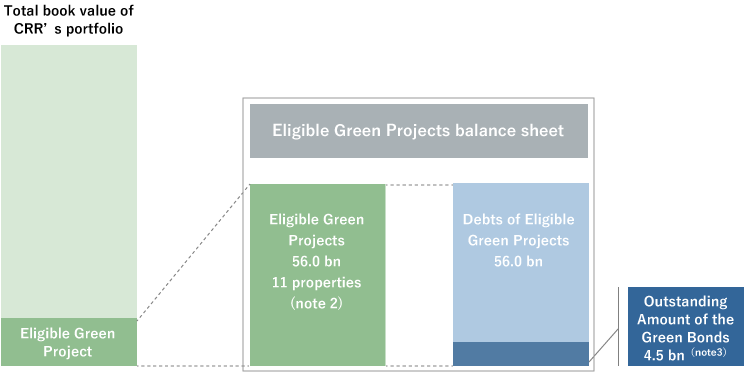

CRR extracts the Eligible Green Projects out of CRR’s portfolio and uses the calculable total book value of the Eligible Green Projects as of the end of the latest fiscal period prior to the date of each bond issuance (note 1) as the Debts of Eligible Green Projects. As long as the Green Bond is outstanding, we will monitor once a year, to ensure that the total amount of outstanding green bonds does not exceed the sum of Debts of Eligible Green Projects and green bond proceeds allocated to refurbishments.

As of January 31, 2024

- “Eligible Green Projects as of the end of the latest fiscal period to the date of each bond issuance” refers to the buildings that have achieved the top three levels of one or more of the third-party green building certifications/recertifications within 36 months prior to the end of the financial period immediately preceding each date of bond issuance.

- The amount of Eligible Green Projects is calculated based on the book value as of January 31, 2024.

- Outstanding amount of the green bonds is calculated as of January 31, 2024.

4. Reporting

CRR will disclose on its website the amount of Eligible Green Projects and/or refurbishments financed/refinanced, allocation status, including the amount of unallocated proceeds, schedule of allocation and managing method, of the net proceeds of green bonds as of end of every January until the proceeds are fully allocated. In the event of major change in situation, such as the accrual of unallocated funds as a result of the sale of relevant assets, such facts will be disclosed in a timely manner. CRR will also disclose that the total amount of outstanding green bonds does not exceed the sum of Debts of Eligible Green Projects and green bond proceeds allocated to refurbishments. Furthermore, after issuance, for as long as the green bonds are outstanding, it will annually report on the book value of all the Eligible Green Projects and the total amount of outstanding amount of the green bonds as of the last day of January in each year.

5. Impact Reporting

As long as there is an unredeemed balance of the relevant green bonds, CRR will annually disclose on its website summary and the progress and levels of certifications of Eligible Green Projects. Additionally, CRR will annually disclose the following indicators of Eligible Green Projects where CRR has energy control authority:

① Energy consumption

② Water consumption

As for the refurbishments that have been funded by the green bonds, the environmental benefits brought by each project will be disclosed. CRR will indicate an estimated rate of reduction (%) of energy consumption and water usage before and after the refurbishment.

Green Bond Summary

| Total issue amount (¥million) | Interest rate | Offering date | Redemption date | Description | Press release | |

|---|---|---|---|---|---|---|

| The 8th unsecured investment corporation bonds (green bonds) | 1,500 | 0.550% | July 30, 2020 | July 30, 2030 | Unsecured | Notice Concerning Issuance of Investment Corporation Bonds (Green Bonds) |

| non-guaranteed | ||||||

| The 10th unsecured investment corporation bonds(green bonds) | 3,000 | 0.460% | July 8, 2021 | July 8, 2031 | Unsecured | Notice Concerning Issuance of Investment Corporation Bonds |

| non-guaranteed | ||||||

| Total | 4,500 | ー | ー | ー | ー | ー |

Impact Reporting

| Energy consumption per year (kWh/㎡) |

Water consumption per year (㎥/㎡) |

|

|---|---|---|

| FY2019 | 134.79 | 0.810 |

| FY2020 | 130.24 | 0.737 |

| FY2021 | 132.40 | 0.744 |

| FY2022 | 123.21 | 0.707 |

| FY2023 | 81.48 | 0.707 |

- Results in the above table are actual figures for the common areas in the Eligible Green Projects of CRR. Energy consumption per year through FY2022 includes usage at some stores.

- The reporting period is from February 1 to January 31 of the next year.

List of CRR's Green Eligible Projects

| Property no. | Property name | Received ranks | Book value at the end of the period (¥ million) |

||

|---|---|---|---|---|---|

| DBJ Green Building Certification |

Certification for CASBEE for Real Estate |

BELS | |||

| 41 | COMFORIA HIGASHIIKEBUKURO WEST | Rank A ★★★★ |

3,536 | ||

| 88 | COMFORIA MINAMISUNAMACHI | Rank S ★★★★★ |

4,489 | ||

| 94 | COMFORIA ITABASHINAKAJUKU | Rank S ★★★★★ |

3,769 | ||

| 98 | COMFORIA SHINJUKU EASTSIDE TOWER |

★★★★★ | Rank S ★★★★★ |

11,342 | |

| 107 | COMFORIA KAMATA | ★★★ | 5,611 | ||

| 125 | COMFORIA SHIBUYA WEST | ★★★★ | 5,400 | ||

| 135 | COMFORIA HIGASHISHINJUKU STATION FRONT |

Rank S ★★★★★ |

5,592 | ||

| 145 | COMFORIA TOYOCHO | Rank S ★★★★★ |

3,715 | ||

| 150 | COMFORIA OMIYA | Rank S ★★★★★ |

4,600 | ||

| 157 | COMFORIA KITAZAWA | ★★★★★ | 4,053 | ||

| 171 | COMFORIA TAKASHIMADAIRA | ★★★ | 3,964 | ||

| Total Eligible Green Projects | 56,077 | ||||

- Listed are the buildings that have achieved the top three levels of one or more of the third-party green building certifications/recertifications within 36 months prior to as of January 31, 2024.

- “Book value at the end of the period” is calculated based on the book value as of January 31, 2024. The book value of COMFORIA SHINJUKU EASTSIDE TOWER is calculated based on the Green-qualified portion of the total assets.